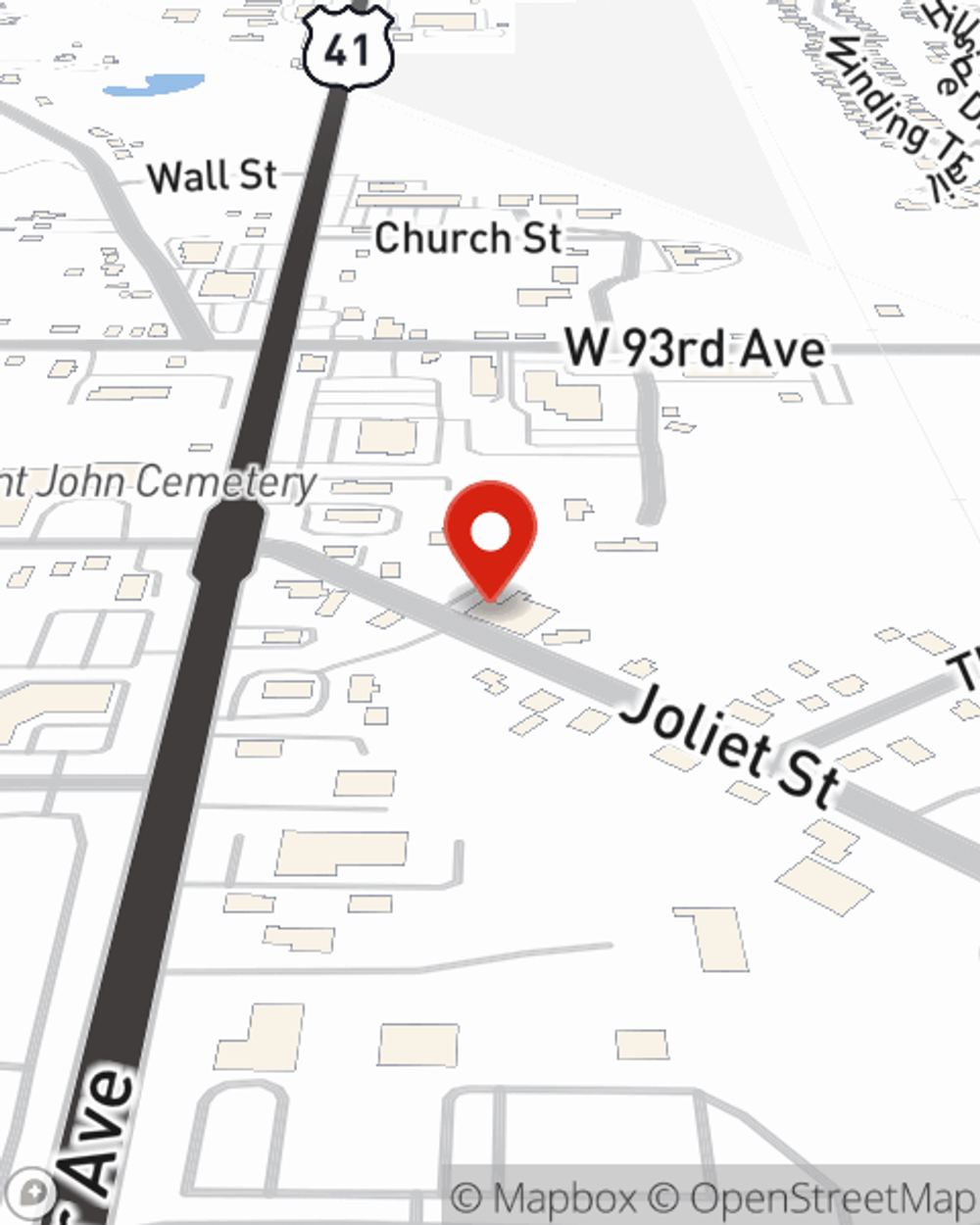

Business Insurance in and around Saint John

One of the top small business insurance companies in Saint John, and beyond.

Cover all the bases for your small business

This Coverage Is Worth It.

Owning a business is about more than being your own boss. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for everyone you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, worker's compensation for your employees and a surety or fidelity bond.

One of the top small business insurance companies in Saint John, and beyond.

Cover all the bases for your small business

Strictly Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a sign painting company, a kennel, or an art gallery, having the right coverage for you is important. As a business owner, as well, State Farm agent Adam Hage understands and is happy to help with customizing your policy options to fit the needs of you and your business.

Agent Adam Hage is here to consider your business insurance options with you. Call or email Adam Hage today!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Adam Hage

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".